The State of AI Mid-2025: A Comprehensive Overview

As we reach the midpoint of 2025, the landscape of artificial intelligence is evolving faster than ever. The State of AI reveals a dynamic…

As we reach the midpoint of 2025, the landscape of artificial intelligence is evolving faster than ever. The State of AI reveals a dynamic environment where private markets dominate growth, reasoning models fuel rapid adoption, and consumer AI usage hits unprecedented levels. This deep dive explores recent insights from two influential reports — Coatue’s macro investment analysis and Menlo’s state of consumer AI study — to paint a vivid picture of where AI stands today and where it’s headed.

Table of Contents

- Private Markets: The Heart of AI Investment

- Public Markets: Steady Growth and Shifting Leadership

- Consumer AI: Rapid Adoption and New Behaviors

- Conclusion: A Midyear Snapshot of AI’s Transformative Journey

- Frequently Asked Questions (FAQ)

Private Markets: The Heart of AI Investment

One of the most striking trends of 2025 is the overwhelming dominance of AI within private markets. AI now accounts for over 50% of all funding this year, a continuation and acceleration of last year’s momentum. What makes this particularly exciting is the increasing likelihood that private funding will surge further as exit opportunities — such as IPOs and mergers and acquisitions — begin to rebound after a multi-year lull.

We’ve been in what can only be described as an “exit desert” since the peak of 2021 during the ZIRP COVID era, which caused significant liquidity challenges. However, signs of revival are emerging with the reopening of IPO windows, increased M&A activity, and the gradual return of de-SPACs as viable paths to going public. This unlocks much-needed capital for AI companies that are growing at extraordinary speeds.

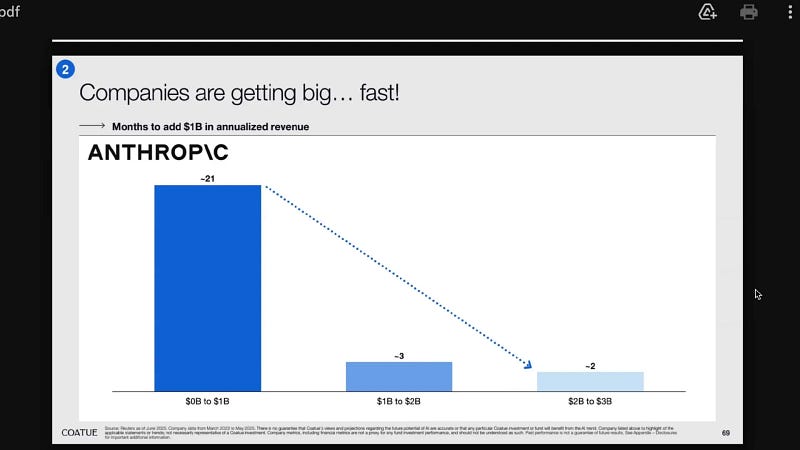

A prime example is Anthropic, which went from zero to $1 billion in annualized revenue in just 21 months. What followed was a rapid acceleration: three months to double to $2 billion, two months to reach $3 billion, and only one additional month to hit $4 billion. This remarkable growth is largely driven by AI coding and assistance tools powered by Anthropic’s advanced models.

With successful exits like CoreWeave’s IPO and growing M&A activity, more capital is set to flow into AI, fueling innovation across diverse themes. For now, the private markets remain the primary arena where the most exciting AI developments and investments are happening.

Public Markets: Steady Growth and Shifting Leadership

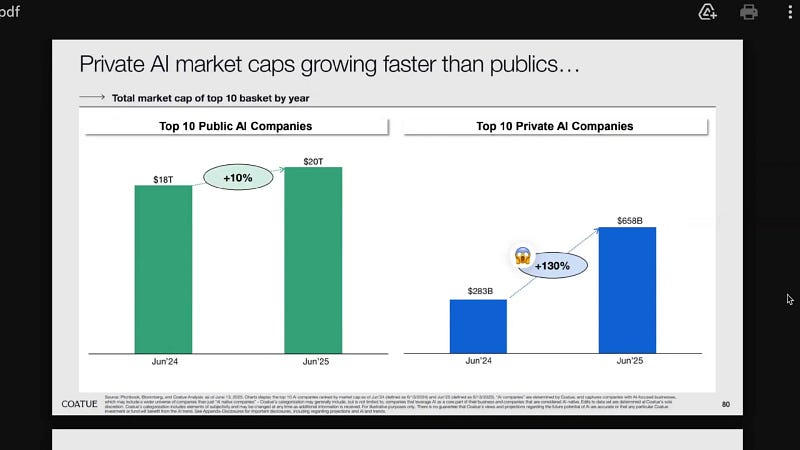

While private markets blaze ahead, public AI companies have seen more modest growth. The combined market cap of the top ten public AI companies increased by only 10% over the past year — from $18 trillion to $20 trillion. In contrast, the top ten private AI companies experienced a staggering 130% growth, climbing from $283 billion to $658 billion.

This divergence underscores the idea that “the action is in the private markets”. New AI startups commonly raise funding rounds exceeding $10 billion, and revenue milestones that once took a decade are now achieved within a year. We are truly in an AI bonanza.

One critical inflection point is the explosion of AI coding tools. Over $1.3 billion in net new revenue was generated within a single year by AI copilots and coding assistants, a trend that continues to accelerate.

The Age of Reasoning and Token Consumption

Coatue calls this period the Age of Reasoning, marked by a surge in token consumption across AI models since the rollout of reasoning models in Q4 of last year. Microsoft exemplifies this with its recent earnings report revealing that it processed over 100 trillion tokens in one quarter — a fivefold increase year-over-year — including a record 50 trillion tokens in a single month.

Additionally, the share of U.S. businesses with paid AI subscriptions jumped from just over 25% in Q4 2024 to 42% in Q1 2025, signaling a positive inflection point as reasoning models become mainstream. ChatGPT itself saw a similar surge following the release of Deep Research and its latest image generation capabilities.

Market Risks and Potential Winners

Despite a few scares — such as concerns over AI ROI, DeepSeek’s challenges, and Microsoft’s capital expenditure worries — the overall narrative remains one of an AI supercycle. However, there is uncertainty about how this supercycle will reshape market leadership.

The so-called Magnificent Seven tech giants, once dominant, now face challenges with four of them showing negative returns year-to-date. This opens the door for new AI leaders to emerge.

Coatue categorizes AI stocks into three segments:

- AI Semiconductors: Companies like Broadcom and TSMC are up 12%, benefiting from increased computing demand driven by token growth.

- AI Software: Firms such as Palantir, Oracle, and Snowflake are seeing growth fueled by AI agents leveraging reasoning models.

- AI Power: Utilities like GE, Vernova, Constellation, and Vistra have risen 18%, driven by electricity shortages and long-term hyperscaler deals.

Compared to the Magnificent Seven’s negative 1% year-to-date performance, these segments highlight where the market’s momentum currently lies.

Potential Challenges Ahead

Three main risks could slow down AI’s trajectory:

- The market becoming too expensive

- Tariffs ending the U.S.’s technological exceptionalism

- Ballooning government deficits

Yet, Coatue emphasizes the difference between a crisis and a correction, noting significant tailwinds such as the easing of AI chip export restrictions — opening broader access to allies — and a renewed energy and nuclear renaissance reversing years of policy paralysis.

The broad shift envisioned is from:

- Autos to semiconductors

- Oil to electricity

- Manufacturing factories to AI factories

- Industrial revolution leadership to AI revolution leadership

This virtuous flywheel could produce a positive productivity deficit cycle, lowering labor costs, inflation, and interest rates, while boosting GDP growth, tax revenues, and improving debt-to-GDP ratios.

Consumer AI: Rapid Adoption and New Behaviors

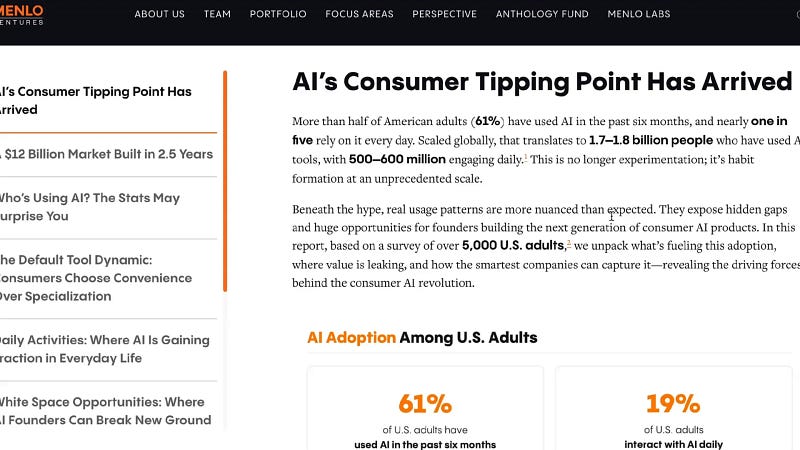

On the consumer front, Menlo’s State of Consumer AI 2025 report confirms how fast AI has become ingrained in daily life. Sixty-one percent of American adults have used AI in the last six months, with 20% using it every day. This isn’t mere experimentation anymore — it’s habit formation at an unprecedented scale.

The study of 5,000 U.S. adults reveals intriguing demographics:

- Gen Z leads overall adoption, but millennials are the power users with more daily usage.

- Nearly half of baby boomers have tried AI, with 11% daily users.

- Employment status matters: 75% of employed adults use AI versus 52% of unemployed.

- Income correlates with usage: 74% of households earning $100K+ use AI compared to 53% under $50K.

- Parents are surprisingly heavy users — 79% have used AI, with 29% daily users, nearly double that of non-parents.

Parents often engage with AI in creative, family-friendly ways: telling interactive stories with ChatGPT, generating images with Midjourney, or making personalized coloring books featuring their children’s favorite characters. These joyful experiences often serve as gateways to exploring more practical AI applications.

Popular AI Tools and Use Cases

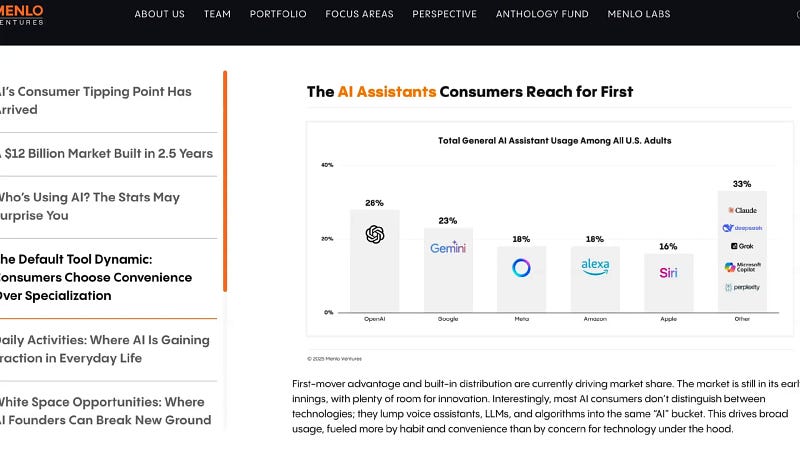

When it comes to AI assistants, two factors dominate usage: convenience and first-mover advantage. ChatGPT holds 28% of general AI assistant usage among adults, followed by Gemini (23%), Meta (18%), Alexa (18%), and Siri (16%).

Top everyday AI use cases include:

- Writing emails

- Researching topics of interest

- Managing to-do lists

- General writing support

- Meal planning

- Managing expenses

- Taking and organizing notes

- Creating images

- Researching purchases

- Researching health questions

Between 14% and 19% of U.S. adults engage with AI for these activities, mostly enhancing tasks they already perform.

AI Coding: A New Digital Literacy

The most transformative change is in AI-assisted coding. Forty-seven percent of respondents use AI for coding in work or school, and 41% for personal projects. Menlo concludes that AI-assisted coding is becoming foundational digital literacy, much like photo editing or slide design was in the past.

Why Some Americans Aren’t Using AI

Despite rapid adoption, 39% of Americans have yet to use AI. Their reasons include:

- 80% prefer human interaction over AI

- 71% worry about data privacy

- 63% don’t see a need for AI

- 58% distrust AI information

- 48% don’t know how to use AI

- 40% believe AI is biased

- 27% lack access to AI tools

Looking Ahead: The Next Wave of AI

Menlo predicts the emergence of a second wave of AI tools moving from generalized assistants like ChatGPT toward specialized applications. This will likely include:

- Full automation and agentic workflows replacing mere assistance

- Multiplayer modes integrating social experiences with AI

- Greater adoption of voice AI

- Physical AI devices entering the home

- Diversified revenue models beyond subscriptions, paralleling enterprise experimentation

The rapid growth from zero to over 60% household penetration in just a few years shows no signs of slowing, signaling a transformative shift in how AI integrates into daily life.

Conclusion: A Midyear Snapshot of AI’s Transformative Journey

The State of AI in mid-2025 is a story of acceleration, innovation, and expanding adoption. Private markets are fueling unprecedented growth and rapid exits, public markets are adjusting to new leaders and new economic paradigms, and consumers are embedding AI into their routines at record speeds. With challenges ahead, the outlook remains optimistic for AI to redefine productivity, economic growth, and societal interaction.

As we continue to track AI’s evolution, one thing is clear: we are witnessing the dawn of a new AI-driven era that promises to reshape industries, economies, and everyday life in profound ways.

Frequently Asked Questions (FAQ)

What is driving the rapid growth in AI funding in 2025?

Over 50% of private market funding in 2025 is dedicated to AI, fueled by rebounding exit opportunities like IPOs and M&A, as well as the fast-growing revenues of AI startups, particularly in AI coding and assistance tools.

How does the growth in private AI companies compare to public ones?

Private AI companies have seen a 130% increase in market cap over the past year, far outpacing the 10% growth of the top public AI companies. This highlights where the most dynamic innovation and investment are currently happening.

What is the “Age of Reasoning” in AI?

The Age of Reasoning refers to the surge in AI token consumption and capabilities driven by advanced reasoning models introduced in late 2024, leading to widespread adoption across businesses and consumers.

Who are the main users of AI among U.S. adults?

While Gen Z leads overall adoption, millennials are the most frequent daily users. Parents also stand out as power users, often using AI to manage childcare and engage creatively with their children.

What are the biggest barriers to AI adoption?

Key barriers include preference for human interaction, concerns about data privacy, lack of perceived need, distrust in AI information, lack of knowledge on how to use AI, perceived bias, and limited access to AI tools.

What trends are expected in the next phase of AI development?

The next wave will likely feature specialized AI tools, full automation workflows, social and multiplayer AI experiences, expanded voice AI, physical AI in homes, and more diversified revenue models beyond subscriptions.

This article was based on the information from State of AI Mid-2025