AI Trends: How Google’s Windsurf Acquihire is Reshaping the Startup Ecosystem

In the fast-evolving world of AI, the recent $2.4 billion acquihire of the AI coding startup Windsurf by Google has sent ripples far beyond…

In the fast-evolving world of AI, the recent $2.4 billion acquihire of the AI coding startup Windsurf by Google has sent ripples far beyond Silicon Valley’s usual circles. What initially seemed like another insider tech acquisition has revealed deeper implications for the AI startup landscape, employee equity, and the competitive dynamics between tech giants like OpenAI, Microsoft, and Google. Today, we unpack this pivotal moment in AI trends and explore why this deal — and others like it — could fundamentally alter how startups operate and how talent is valued in the AI era.

Table of Contents

- Understanding Windsurf and the AI Coding Landscape

- The Windsurf Acquisition That Never Was: OpenAI, Microsoft, and Google

- Google’s Acquihire Deal: Structure and Controversy

- The Employee Fallout: Broken Trust in Startup Equity

- Industry Perspectives and Cautionary Voices

- The Larger Pattern: Blitz Hire Acquisitions and Their Impact

- The Future of AI Startups and Talent Wars

- What This Means for OpenAI and the Broader AI Landscape

- Conclusion

- Frequently Asked Questions (FAQ)

Understanding Windsurf and the AI Coding Landscape

Windsurf is a prominent player in the AI coding assistance space, specifically in what’s known as “vibe coding” or agentic coding. While products like Bolt and Lovable target nontechnical users who can code through natural language, Windsurf leans closer to the “Cursor” end of the spectrum — offering an AI-powered integrated development environment (IDE) tailored for knowledgeable programmers. This sector has become one of the hottest in AI this year, with every major AI lab racing to build or acquire their own AI coding platforms urgently.

The AI coding market represents the biggest land grab for AI use cases since the chatbot boom after ChatGPT’s release. OpenAI initially appeared set to acquire Windsurf for $3 billion back in May, signaling their commitment to securing a strong foothold in this space. They even launched their own coding tool, Codex, shortly after. But acquiring an established product, alongside its user base and talent, promised much faster progress and market penetration.

The Windsurf Acquisition That Never Was: OpenAI, Microsoft, and Google

Despite Windsurf’s reported $100 million annual recurring revenue (ARR) and a planned funding round at a $3 billion valuation, the startup faced intense pressure from multiple fronts: emerging vibe coding platforms, competing agentic IDEs, and hyperscalers who both power and compete with these platforms.

In early June, Windsurf was cut off from direct access to Anthropic’s Claude models — a move believed to be in response to OpenAI’s pending acquisition. This restriction increased costs and operational challenges for Windsurf, further complicating its position.

By mid-June, it became clear that the OpenAI-Windsurf deal had hit a major roadblock due to Microsoft’s involvement. As the key investor and gatekeeper for OpenAI’s transition to a for-profit public benefit company, Microsoft demanded rights to all of OpenAI’s intellectual property (IP), including that of Windsurf if acquired. Windsurf, on their part, was uncomfortable granting Microsoft such access.

Microsoft’s subsequent partnership with Replit to offer integrated vibe coding was a strong signal that the Windsurf deal was unraveling. When the exclusivity window on the OpenAI deal expired, Google stepped in with a different approach.

Google’s Acquihire Deal: Structure and Controversy

Google’s deal involved hiring Windsurf’s CEO Varun Mohan, cofounder Douglas Chen, and select R&D employees, while paying $2.4 billion to license Windsurf’s IP. Unlike a traditional acquisition, Google did not make a formal investment in the company, allowing Windsurf to continue operating independently as an employee-owned entity focused on enterprise customers.

This “wonkily structured” acquihire circumvents antitrust scrutiny by avoiding a full acquisition. Google’s new employees could start immediately, but many Windsurf employees — especially those who joined less than twelve months ago and had not vested equity — were left without meaningful payouts despite their contributions.

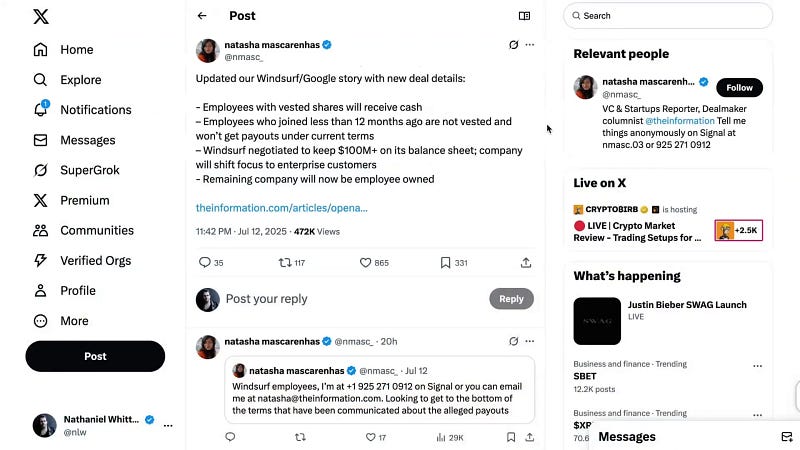

Natasha Moskarenas from The Information highlighted that employees with vested shares would receive cash, but many recent hires without vested shares would get nothing. Windsurf negotiated to keep $100 million on its balance sheet, but the remaining company faces a steep uphill battle against its former founders now at Google and other competitors like Cursor and Anthropic.

The Employee Fallout: Broken Trust in Startup Equity

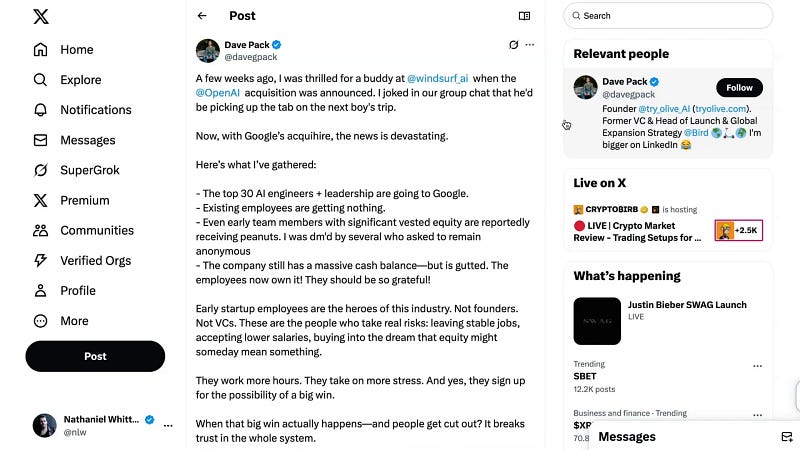

Entrepreneur Dave Pack captured the frustration felt by many in the startup community. Early employees who risked stability for equity and the dream of a big payoff are reportedly receiving little to no compensation. Dave emphasized that this “acquihire to dodge regulatory scrutiny while stiffing your team is greed disguised as compliance.”

“Early startup employees are the people who take real risks, leaving stable jobs, accepting lower salaries, buying into the dream that equity might someday mean something… When that big win actually happens and people get cut out, it breaks trust in the whole system.”

This deal threatens to undermine the traditional startup model where equity serves as a key motivator. If such acquihires become the norm, startups could be staffed by mercenaries rather than missionaries, eroding the culture of innovation and loyalty.

Industry Perspectives and Cautionary Voices

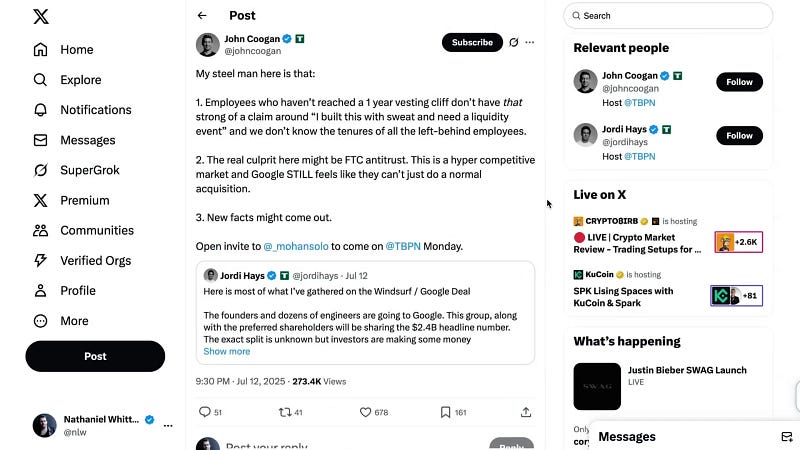

Jordy Hayes of TVPN confirmed that founders and a select group of engineers are benefiting handsomely from the deal, while hundreds of other employees are left without fair compensation. Windsurf’s leadership argues that the remaining company’s revenue and balance sheet make it a win for those staying behind, but given Google’s license to the core technology, many predict Windsurf will struggle and possibly fail.

Some voices, like John Coogan, urge caution and context. He points out that employees who haven’t passed the standard one-year vesting cliff may not have strong claims to equity payouts and suggests that antitrust regulations and a hypercompetitive market also complicate these deals. Furthermore, communication challenges may have exacerbated employee frustrations, with some updates indicating that fair outcomes may still be negotiated.

The Larger Pattern: Blitz Hire Acquisitions and Their Impact

Windsurf’s story is part of a broader trend dubbed “blitz hire acquisitions,” where companies acquire key talent and IP rapidly while leaving behind a shell company. Other examples include Scale AI’s partial sale to Meta, Google’s acquihire of Character AI leadership, and Microsoft’s licensing deal with Inflection.

While these deals allow tech giants to onboard talent quickly — sometimes overnight — they often leave the remaining company in a precarious position, struggling to compete or raise further funding. For Windsurf, industry insiders widely predict a grim future, with many urging enterprise customers to transition away from its products.

The Future of AI Startups and Talent Wars

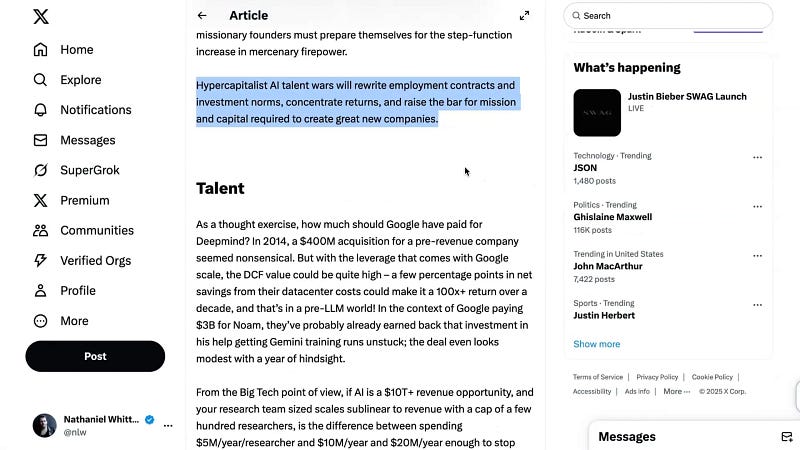

Experts like John Lettig from Founders Fund foresee a seismic shift in how talent is valued, with hypercapitalist AI talent wars reshaping employment contracts and investment norms. The capital cannon is now firing at talent acquisition, potentially concentrating returns and increasing the demands on founders and investors alike.

We may see employment agreements resembling sports or entertainment contracts, with a premium on securing and retaining top AI engineers. This recalibration could redefine the startup ecosystem and the very meaning of equity and loyalty in the AI age.

What This Means for OpenAI and the Broader AI Landscape

OpenAI, already navigating intense competition from Meta and Microsoft, faces additional challenges after losing out on the Windsurf deal. The hypercompetitive dynamics and high stakes of AI innovation are disrupting long-held norms in startup operations and acquisitions.

Ultimately, the Windsurf acquihire exemplifies how yesterday’s startup expectations are rapidly evolving. As AI trends accelerate, the ecosystem must adapt — balancing speed, regulatory considerations, employee equity, and innovation sustainability.

Conclusion

The Google acquihire of Windsurf is more than just a tech acquisition story; it’s a window into the shifting sands of AI trends, startup culture, and talent valuation. While it highlights the urgency for tech giants to secure AI capabilities quickly, it also raises critical questions about fairness, trust, and the future of startup equity.

As these blitz hire deals become more common, founders, employees, and investors must rethink the incentives and structures that fuel innovation. The AI revolution is not just about technology — it’s about people, culture, and how we build the future together.

Frequently Asked Questions (FAQ)

What is an acquihire, and how does it differ from a traditional acquisition?

An acquihire is a deal where a company primarily acquires a startup’s talent rather than buying the entire company outright. In Google’s Windsurf deal, this meant hiring key employees and licensing IP, while leaving the startup as a separate entity. Traditional acquisitions usually involve buying the whole company and integrating it fully.

Why are acquihires like Windsurf’s controversial?

They often result in many employees, especially recent hires without vested equity, receiving little or no compensation despite their contributions. This can break trust in the startup equity model and may leave the remaining company struggling to survive.

How does the one-year vesting cliff affect startup employees?

Equity in startups typically vests over four years with a one-year cliff, meaning employees must stay at least one year to earn any equity. Those who leave or are cut before the cliff receive no equity, which can be significant in acquisition scenarios.

What are “blitz hire acquisitions” and why are they becoming more common?

Blitz hire acquisitions are deals designed to quickly onboard key talent and IP while avoiding lengthy regulatory reviews. They leave behind a shell company and allow the acquirer to start work immediately. This speed is crucial in AI, where market dynamics change rapidly.

What does the Windsurf deal mean for the future of AI startups?

It signals a shift in how talent and innovation are valued, with an increased focus on rapid talent acquisition by big tech. This could lead to new employment contract models, challenges to traditional equity incentives, and a reevaluation of startup culture and funding.

This article is based on comprehensive research derived in part from the referenced video Are AI Acquihires Screwing Up the Startup Space?